There are multiple pricing strategies for freelancers. Charging for time is the most common and universal. However, it can be tricky to determine the appropriate rate. In this article, I explain a few calculation methods, list concrete numbers, and share helpful resources. I explain how to find freelance UX projects in another article.

Method 1: Calculate your Minimum Acceptable Rate

There is one simple rule for freelance rates: Never charge less money than you need to live. Simple enough – but how little is too little? To figure that out, you need to calculate your total costs (expenses, insurance, and taxes) and divide them by the number of working days.

Business and Living Expenses

Your business expenses as a freelancer include all costs necessary to deliver a service or product to your customers. For example, office rent, software licenses, computer hardware, training, and marketing.

Your living expenses consist, among other things, of rent, food, clothing, mobility, and (private) insurance. It’s very helpful to create lists for these costs and calculate your total expenses. You can look at your account statements from the previous year, record your expenses for a few months in a budget book, or use apps like Finanzguru or Outbank.

Healthcare and Pension Insurance

As a freelancer in Germany, you must pay for health and care insurance (Kranken- und Pflegeversicherung). The exact rate depends on whether you have statutory or private insurance (Gesetzliche / Private Krankensversicherung). In the case of the former, the Techniker Krankenkasse offers a simple tool to calculate your healthcare contribution. It’s based on your income, lies between 200-910€ per month, and is almost the same for all statutory insurance companies. Private insurance calculates contributions individually based on income, age, and physical condition. To get a first price indication, the Ottova calculator for their private health insurance is nice and well-designed.

As a freelancer in a “creative industry” such as UX and UI design, you can take advantage of the Künstlersozialkasse (KSK – artists’ social insurance), which takes over 50% of health and care insurance costs. When you become a member of the KSK, you’ll have to pay into German pension insurance (Rentenversicherung), which is an additional cost, but it’s still a good deal! Freie Wildbahn e.V. offers a simple tool to calculate your KSK contributions.

You’re not obligated to pay for unemployment insurance (Arbeitslosenversicherung) or pension insurance. However, you should take a look at both insurances and decide for yourself, whether it makes sense in your situation. Especially saving for retirement is a very important topic and you should carefully evaluate the various options! For the sake of simplicity, the following example calculations include 1000€ per month as pension reserve and no contributions towards unemployment insurance.

Income Tax

Income tax in Germany ranges from 14-45%. The Germany Federal Ministry of Finance offers an online tool to calculate your income tax rate. Additionally, if you’re liable for church tax (Kirchensteuer) this costs 8% of your income tax and, if you earn a lot, you’ll have to pay the solidarity surcharge (Solidaritätsbeitrag), which is 5,5% of your income tax.

Working Days

The number of 200 working days is a good approximation. It accounts for public holidays in Germany, 30 vacation days, and around 15 days of absence, e.g., due to sickness. However, this also means that you’re fully booked throughout the year and you have little to no idle time between projects.

You should never go below your minimum rate! Otherwise, you will not be able to sustainably run a profitable business. “Profitable” is even a bit of an exaggeration, since you can hardly cover your costs with this daily rate. Use one of the following two methods to calculate a market-typical and more profitable rate so you don’t sell yourself short or cause trouble for other freelancers through wage dumping.

Method 2: Calculate from (Desired) Income

Another method of calculating a daily rate is determining your desired annual income and dividing it by the number of working days. This is especially helpful when you move from a permanent position to being freelance because you can use your current salary as a starting point.

You can also base your calculation on statistical data, e.g., from one of the following sources (all figures are rounded and refer to yearly full-time gross salaries):

- The Entgeldatlas of the German Federal Employment Agency lists 40.800€ (3.400€/month) as the mean salary in 2021.

- According to Stepstone 42.200€ (3.500€/month) is the average yearly salary in 2023.

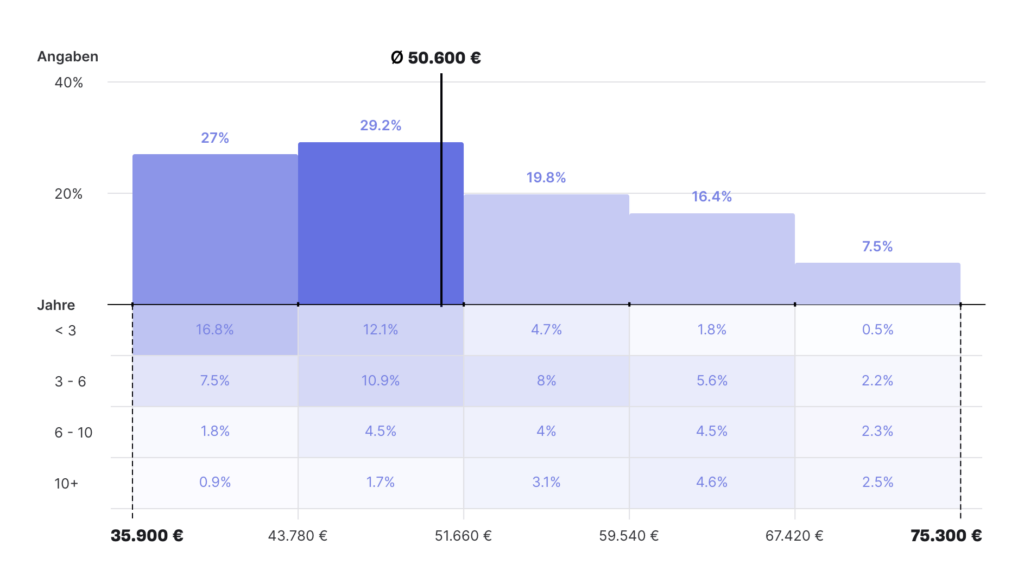

- Gehaltscheck by kununu nicely visualizes salary ranges and reports an average of 50.600€ (4.200€/month) in 2023.

- The Branchenreport of the German Usability Professionals Association lists 62.000€ (5.166€/month) as average in 2023.

- The website levels.fyi lists 71.000€ (5.900€/month) as the median total compensation for a Product Designer in 2023.

- UX Design Report 2023 by Konzepthaus reports 75.600€ (6.300€/month) as the annual salary for designers with a bachelor’s degree and no leadership role.

Of course, salaries vary depending on education, experience, industry, type of company, and location. If you want to dig deeper, the resources above break down the salary distribution according to various criteria.

Starting from your (desired) yearly salary, you need to add the employer’s 50% share of health and care insurance. Assuming that you don’t have unemployment insurance you can deduct the contributions since it’s mandatory insurance for employees and therefore already included in the gross salary. Finanzfluss offers a practical calculator for social security contributions that lists the various deductions.

Freelancers typically charge more than their salaried counterparts since they carry a higher entrepreneurial risk. They don’t earn anything, during any absence from work (vacation, sickness), a lack of projects, or when a customer can’t pay. It’s hard to propose a number but, I’d personally factor in a risk premium of at least 30%.

Kajy Calculator

The Allianz deutscher Designer (AGD) offers a very helpful hourly rate calculator called “Kajy”. It’s based on the described method and guides you through the calculation step by step.

Method 3: Competitive Analysis

A third method is conducting a competitive analysis to determine market-typical rates. This method requires gathering data on what other freelance UX designers with similar skills and experience are charging for their services. Besides asking fellow freelancers, you can take a look at the following sources:

- The Freelancing in Europe 2022 study by Malt and BCG lists 615€ as the daily rate in the category “Arts and Design” in Germany.

- Malts’ Barometer of Freelance Rates breaks down daily rates according to experience, area of expertise, and city. In early 2023 reports ~650€ as the average for UX designers. Designers in Munich earn the most and in Cologne the least due to differences in economic strength and the cost of living.

- The Branchenreport 2023 of the German UPA includes daily rates from 600-1.000€ with an average of 735€ (down from 800€ in 2022).

- The hourly rate calculator by Gulp nicely shows the distribution of hourly rates for UX freelancers ranging from 30-150€ with a clear majority at 90€ (720€ / day).

- Freelancer Kompass 2023 by freelancermap.de doesn’t specifically mention UX freelancers but reports an average daily rate of 800€.

Additional Considerations

A fair rate reflects your skills, experience, and value proposition while remaining competitive in the market, and covering your cost as well as your entrepreneurial risk.

When setting your rate, it’s essential to consider your education, experience, and expertise as well as the region, industry, and type of company you’re working with. For example, freelancing for a large corporation in a major city like Munich may command a higher rate than working for a small start-up in a rural area. According to the UX Design Report 2023 by Konzepthaus, the highest-paying industries are logistics, medical technology, and energy. The worst-paying industries are telecommunication, mobility, and real estate. If you work for an agency or a recruitment company, they usually take a share of 5-20% of your daily rate as commission. It’s also important to keep in mind that once you’ve established a price with a customer, it can be hard to raise it. You will need good arguments, as to why your design work is more expensive today than it was yesterday.

As a freelancer, you have higher risks than an employee, and it’s essential to take appropriate precautions. This includes cash savings for hard times (3-6 months income), sufficient savings for retirement, and reasonable insurance.

Further Resources:

- Tagessatzrechner für Freelancer by Malt including an Excel template

- Welchen Stundenlohn Du als Freelancer verlangen solltest by Kontist

- How to set your freelance rate and decide your pricing by N26

- How to set your rates as a freelancer by freelancermap

Disclaimer: I have written this article based on my experience and to the best of my knowledge. However, I take no responsibility for the completeness and correctness of the information and sample calculations. If you spot any errors, please let me know.